About US

Who we are?

Sequel Partners works with owner-managed businesses that are ambitious to grow and want greater clarity, control, and confidence in their decisions.

Most of our clients operate in technology, software, media, and other growth-driven sectors, typically at a stage where basic compliance and bookkeeping are no longer enough. They have momentum, complexity, and opportunity — but need sharper financial insight to scale sustainably.

We act as a long-term partner, helping founders understand where they are today, where they want to go next, and how to build a credible financial path to get there.

Our support is structured around four core pillars:

Structured financial support

Operational clarity at the core

Strategic financial advice including Forecasting and Board Level Reporting

Funding advice and Exit Planning when you need it

How we add value

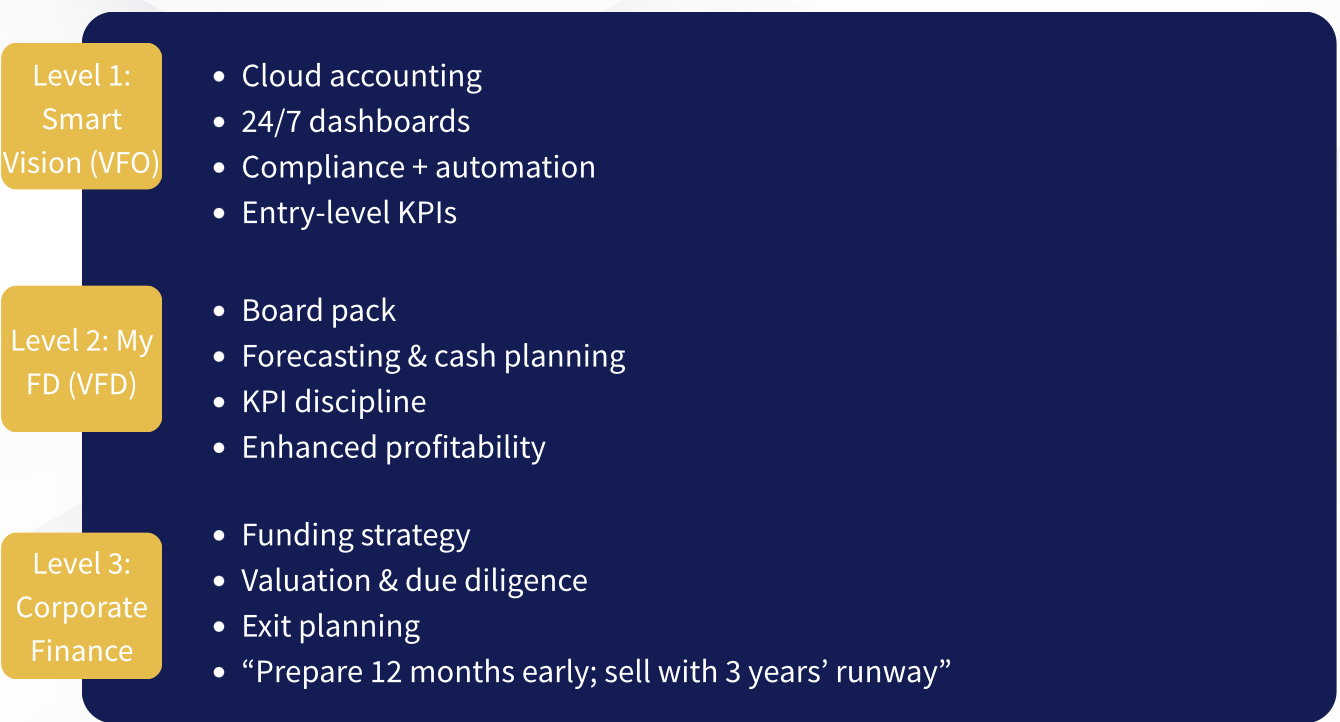

A clear, staged growth model

Structured financial support that evolves with your business.operational clarity at the core

Clean data, automation, and real-time insight into performance.Strategic financial leadership

Forecasting, KPIs, and board-level guidance as you scale.Support for critical decisions

Funding, valuation, and exit planning when complexity increases.

We focus on outcomes, not output

We don’t measure success by the number of reports produced or spreadsheets delivered.

What matters is the outcome:

Clear visibility over cash, profit, and performance

Better, faster decisions supported by forward-looking numbers

Reduced uncertainty and founder overwhelm

A business that is prepared for growth, funding, or exit — before it becomes urgent

Our work is designed to move businesses from reactive decision-making to structured, confident planning. Outputs only matter if they lead to meaningful outcomes.

The Growth Ladder

Why we are different

Traditional accounting focuses on reporting what has already happened. Our approach is advisory-led and forward-looking.

We combine clean financial foundations with strategic insight, using real-time data, forecasting, KPIs, and scenario planning to support better decisions — not just year-end compliance.

Rather than delivering fragmented services, we integrate day-to-day finance, strategic oversight, and capital readiness into a single, joined-up model. This gives founders a clearer narrative, stronger control, and the confidence to make proactive decisions.

Our role is not to record history, but to help shape what comes next.